Peter Lynch probably is best known for picking 10 baggers. In his writings (e.g., Beating the Street is my favorite one), he divided stocks into 6 categories ranging from stalwarts, to turnarounds, to fast growers. And fast-growers seem to be Lynch’s favorites. These are stocks that can grow their annual earnings at 20%+ year. He mentioned multiple times an investor’s biggest gains come from fast growers. However, these fast growers are also inherently riskier.

As such, he provided some guidelines for limiting the risks, which leads me to the main thesis of the day. in the remainder of this article, I will explain why Tesla, Inc. (NASDAQ:TSLA) begins to fit these guidelines under current conditions. More specifically,

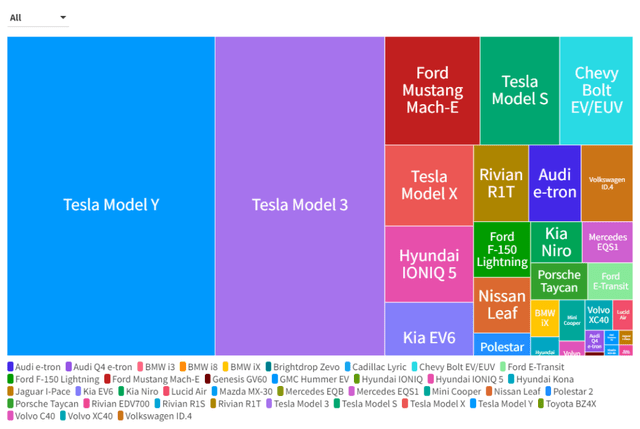

Tesla has been the leading producer and seller of electric vehicles globally for several years. Other major EV makers such as Volkswagen, General Motors, and Toyota have also been ramping up their electric vehicle production and sales in recent years, but their numbers are still significantly lower compared to Tesla's as you can clearly see from the following chart. TSLA is the clear leader, with its Model Y and Model 3 X occupying the top 2 spots in market shares with Ford Mustang as distant third.

Looking ahead, I see its leading position to sustain for various reasons, with scale itself and brand appeal as the top ones.

In terms of manufacturing scale, Tesla has already passed the critical economies of scale as argued in my earlier articles, making it much more cost-competitive compared against other makers. And Tesla has cultivated a strong brand image and captured a large fan base with its sleek and minimalist design. At the same time, it keeps introducing “cool” features such as autopilot and over-the-air updates to keep the fans excited and anticipating.