Tesla, Inc. (NASDAQ:TSLA) reported excellent FQ1'22 earnings on 20 April 2022, leading the stock to rise 3.25%. The company delivered record 310K vehicles in the quarter, representing an increase of 0.45% QoQ and 67.7% YoY. Given that its Gigafactories in Berlin and Texas are already ramping up with deliveries started in March and April, respectively, we may expect record production and deliveries in FQ2'22. However, we project that it could be potentially offset by the reduced production in its Shanghai Gigafactory by at least 25%, given the prolonged COVID-19 lockdowns in China.

Though Dan Ives, the Managing Director of equity research at Wedbush Securities, had said that TSLA's delivery numbers in FQ1'22 look almost 'Cinderella-like', we are uncertain if the current rally may survive the ongoing uncertainties.

Given China's Zero Covid Policy, we expect further hurdles for TSLA's Shanghai Gigafactory, despite the adoption of a close loop system. First, the company reportedly only has access to a week's worth of production inventories, resulting in a single-shift operation instead of the usual double shift. As a result, the factory is only able to assemble 1K vehicles a day for now. TSLA would have incurred a loss of approximately 80K production units, including a 50K loss during the 22 days of lockdown in the first three weeks of April. The projection is based on the assumption that the city does not resume normal operations by mid-May, with a steady stream of component deliveries and only 1K EV output a day.

On the other hand, David Zhang, a researcher at the North China University of Technology, estimated that it would take several weeks for TSLA to ramp up its Shanghai production to full capacity, given the citywide lockdown, closed highways, reduced truck movements at 15% of normal levels, and scarcity of parts due to the ongoing lockdowns in the vendors' factories as well. Though nationwide COVID-19 test passes could be distributed to Chinese truck drivers, the implementation of the passes and, consequently, the recovery in logistics would be still slower than the installed production capacity in TSLA's Shanghai Gigafactory. Roy Wang, a senior manager with Shanghai Wings Supply Chain Management, said:

The full restoration of the entire supply chain in the automotive industry cannot be completed until May if the lockdown [of Shanghai] is not lifted. Efforts to restart production do not only involve policymaking in Shanghai, but support from other parts of the country. (SCMP)

Despite Elon Musk's 'assurance' during its latest earnings call that its Shanghai Gigafactory can still produce the same amount in FQ2'22 as in FQ1'22, we are not convinced as the facts state otherwise. CEO of XPeng had even gone as far as to report that all Chinese-based automakers would have to suspend all production by May, if the 'nationwide' lockdowns continue. Due to the start-stop lockdowns in approximately 45 major cities in China, nationwide automotive suppliers and assemblers have been and will continue to be out of sync for easily the next few weeks. Though China Passenger Car Association (CPCA) had projected an impact of up to 40% loss in automotive production for May 2022, we believe its estimates are rather conservative given the current situation.

In addition, Elon Musk had estimated total vehicle deliveries in the range of 1.4M to 1.5M for FY2022, at a 50% to 60% annual growth, despite its over 2M installed production capacity from its four Gigafactories. It is evident that global supply chain issues remain an issue for the biggest global EV maker in 2022, since its factories have been running below capacity for several quarters. We believe TSLA potentially aims to balance out Shanghai's reduced output through its two newest Gigafactories in Berlin and Texas. However, since both factories are still ramping up with global chips and raw material shortages still at play, we doubt the resulting capacity can mitigate Shanghai's highly efficient and massive output of 2K a day.

ASML Holding's Chief Executive Officer Peter Wennink had also said that the demand for semiconductor chips had been massively outstripping supply and production capacity, with certain companies resorting to scavenging chips from washing machines to cope with unrelenting demand. As a result, we expect TSLA's production in Berlin and Texas to meet similar issues, delaying its ramping up progress and further extending the waitlist for its vehicles. Nonetheless, assuming a somewhat optimistic stance that TSLA could successfully ramp up production in Berlin and Texas by H2'22 while also hoping for a resumption of normal operations in Shanghai simultaneously, the company may easily achieve its goal of 1.5M vehicles delivery by the end of the year. We shall see. Analyst Dan Ives said:

We believe 1.5 million units of deliveries for the year is hittable and could be exceeded, however, it all rests on the China issues seeing no more shutdowns from this point and Berlin and Austin ramping according to plan. (Seeking Alpha)

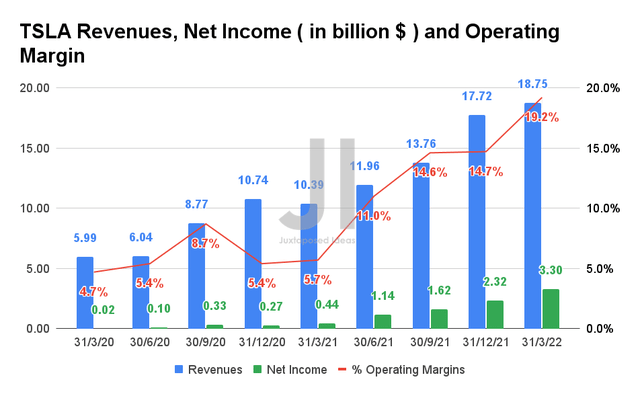

TSLA Revenue, Net Income, and Operating Margin

S&P Capital IQ

TSLA reported revenues of $18.75B for FQ1'22, representing an impressive increase of 5.81% QoQ and 80.4% YoY. Its net income jumped over 7-fold YoY as well, from $0.44B in FQ1'21 to $3.3B in FQ1'22, primarily attributed to the growth in its operating margin from 5.7% to 19.2%. However, we expect TSLA's operating leverage to be adjusted downward, since it will need to take into account the ramp-up of the Texas Gigafactory and Berlin Gigafactory in FQ2'22. Nonetheless, we are confident that the company would be able to protect its bottom line, given how it has adjusted its EV pricing for inflation and increased raw material costs. However, it is also essential to note that the price increases are only relevant for the next few quarters, since the reported revenues are based on orders placed in prior quarters.

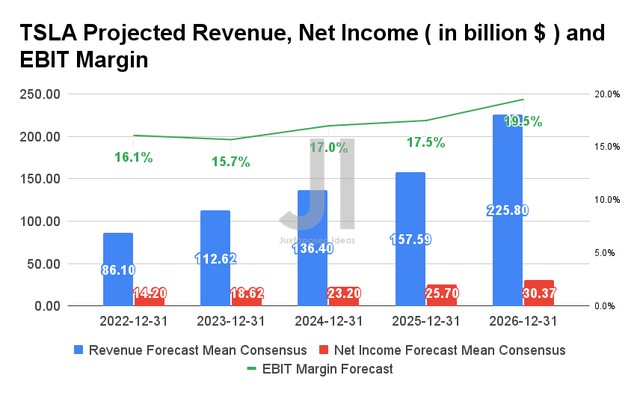

TSLA Projected Revenue, Net Income, and EBIT Margin

S&P Capital IQ

TSLA is expected to grow its revenues at an impressive CAGR of 33.23% over the next five years. For FY2022, consensus estimates that the company will report revenues of $86.1B and net income of $14.2B, representing remarkable YoY growth of 60% and 257%, respectively. In addition, its EBIT margin is expected to improve tremendously, from 12.1% in FY2021 and 16.1% for FY2022. As a result, it is evident that TSLA is still expected to deliver its stellar performance for the fiscal year, despite the temporary headwinds from its Shanghai Gigafactory.

Moving forward, we also expect TSLA to further increase its capital expenditures as it continues to ramp up its manufacturing capacity in order to meet its annual goal of 20M vehicles output. Nonetheless, we also expect the increase to be incremental over this and the next decade, given that the company only delivered slightly less than 1M in FY2021.

TSLA 3Y EV/NTM Revenue

S&P Capital IQ

TSLA is currently trading at an elevated EV/NTM Revenue of 10.87x, higher than its 3Y mean of 8.76x. Given its excellent execution in FQ1'22, consensus estimates still rate TSLA stock as attractive, despite its overvaluation. The stock is currently trading at $1008.78 on 21 April 2022, up 31.6% from its March lows of $766.37, though still down 23.6% from 52 weeks high of $1243.49. Given its current premium valuation, we encourage some patience for tech investors before adding, given that TSLA is trading above its 50 and 100 days moving average.

In our opinion, the stock may potentially retrace in July, when TSLA reports its Q2 vehicle deliveries, which would definitely reflect a reduced output from its Shanghai Gigafactory. As a result, it would create a more attractive entry point for long-term TSLA investors who add to their portfolios regularly.